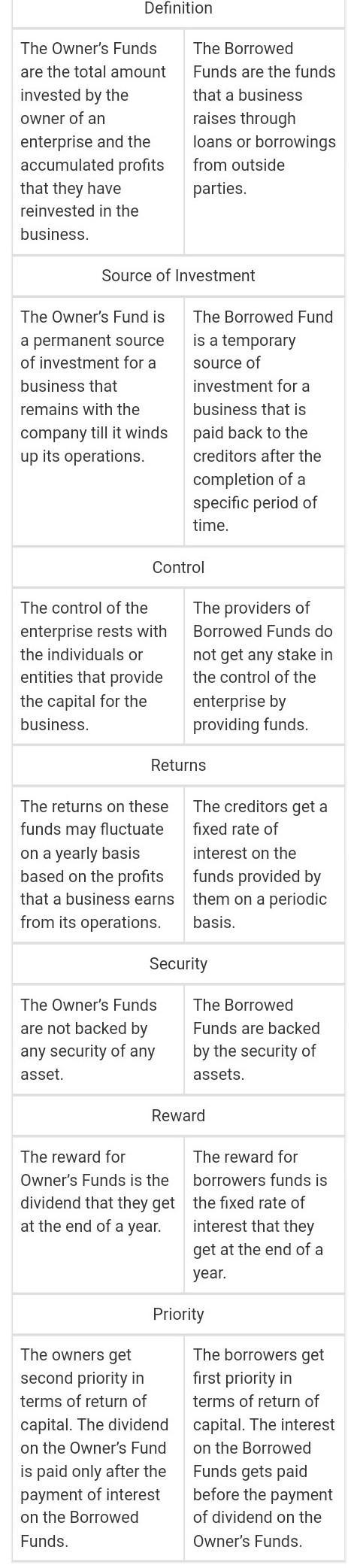

Define Owners Funds with examples merits and demerit features. Define Borrowed Funds with examples merits and demerit features. Define Shares with examples merits and demerits. Different between owners funds and borrowed funds with examples.

-

Subject:

Business Studies -

Author:

misha20 -

Created:

1 year ago

Answers 1

Answer:

Owner’s FundsThe Owner’s Funds are the total amount invested by the owner of an enterprise and the accumulated profits that they have reinvested in the business. This money remains invested in the business till the company winds up its operations. It is the primary source of funds, without which it is difficult for any organisation to survive in the market. The owner may be an individual, a group of partners or shareholders in the business. The capital invested by the owner/s allows them control over their business. Some entrepreneurs may prefer to keep the control of the company to themselves, while others may opt for sharing the control and risk of a business by bringing in other investors.

Borrowed FundsThe Borrowed Funds are the funds that a business raises through loans or borrowings from other parties. They are the most common sources of capital for any enterprise. Some of the methods of raising Borrowed Funds are as follows:

- Raising loans from commercial banks or other financial institutions

- Issuing of debentures and bonds

- Public deposits

- Trade Credit

The creditors provide these funds only for a specified period of time, and they have to return after the expiry of that period. A business can avail these funds only under certain terms and conditions, which they need to fulfil at all costs. The borrowers must also pay a fixed amount of interest on these funds to the lenders, irrespective of whether the firm is making a profit or not. The creditors give these funds on the security of assets of the firm in most cases.

Advantages of self-financing your business:

- You will know exactly how much money is available to run your business and you will not have to spend time trying to secure other forms of funding from investors or banks.

- Self-financing your business gives you much more control than other finance options. It also means that you don't need to pay back or rely on outside investors or lenders, who could decide to withdraw their support at any time.

- You will retain full ownership of the business, which in turn means that you will receive 100 per cent of future profits.

- If you fund a business yourself, you will be forced to live within your means, only investing in business equipment and marketing when you need to. This can help you to prioritise your business expenditure and avoid excessive spending.

- Using your own money to finance your business may put a strain on your family and personal life. You may not have enough money left over to cover your living costs. You should try to leave a contingency fund, in case you need extra money to see you through a difficult period.

- If your business were to fail, you could lose your home and other personal possessions.

- Many investors and venture capitalists can also provide mentoring and networking opportunities for you and your business - if you fund your business alone, you will have to develop your own contacts and mentoring opportunities.

Find the attachment.

The solution is given here.

-

Author:

ethan487

-

Rate an answer:

7